How CPOs Can Transform Brand Identity with Astute Packaging Design

How CPOs Can Transform Brand Identity with Astute Packaging Design

As the Chief Procurement Officer of a manufacturing enterprise, your efforts extend beyond typical sourcing obligations.

Your decisions determine how people see your brand and influence how they interact with it.

This impact is especially noticeable in packaging.

It’s no longer only about preserving things; it’s a strong weapon for enhancing your brand’s image and attracting loyal customers.

As a CPO, you may leave a mark on customers’ minds in a variety of ways, but none are more enduring than the packaging experience. Let’s better grasp this.

Packaging Is Your Brand’s First Touchpoint

In today’s crowded marketplace, packaging is often the first point of contact a consumer has with your brand. Consider the exhilaration of unwrapping a new product—it’s a well-planned moment that can set the tone for the entire brand experience.

For brands like Apple, sleek and minimalistic packaging communicates innovation and premium quality before you even get to the product.

As a CPO, you have the opportunity to make packaging choices that tell a similar story about your brand, whether it’s luxury, sustainability, or customer-centric innovation.

The right packaging can influence consumer perceptions long before they use the product itself, making it a powerful branding tool.

Sustainable Packaging Builds Trust

Many consumers today prioritize sustainability, and your packaging choices can reveal a lot about your brand’s principles.

By using eco-friendly materials or decreasing trash, you not only appeal to environmentally conscious customers, but also demonstrate that your company is concerned about its environmental impact.

Consider companies like Unilever or Nestlé, which have made sustainability a core part of their brand message through eco-friendly packaging initiatives.

For CPOs, aligning packaging strategies with sustainability can help reinforce trust and loyalty with your customers.

And if you’re looking for guidance in this area, Moglix Business offers a wide range of sustainable packaging solutions that can help your brand lead the way in environmental responsibility.

Create Memorable Experiences

There is smarter packaging than simply being environmentally responsible. It allows you that extra layer of tangible conversation with your customer.

Consider packaging that lets them engage with QR codes, NFC chips, or even augmented reality (AR).

These aspects turn a mandatory, boring, ignorable unwrapping experience into a personalized blockbuster event, allowing your brand to start on an impressive note and build on that first impression.

Customized Packaging Strengthens Consumer Loyalty

Personalized packaging has been a game changer in recent years.

The success of Coca-Cola’s “Share a Coke” campaign, where bottles featured individual names, is a prime example of how customized packaging can foster deeper connections with consumers.

As a CPO, working with suppliers that offer customized packaging can help differentiate your brand and foster customer loyalty. Personalized boxes, limited edition designs, or tailored packaging experiences—these touches make your business feel unique and consumer-focused

Partnering with the Right Packaging Providers

This is the truth: Your packaging is only as effective as the partners you choose, and it is an ongoing process of continuous improvement.

To build innovative, sustainable, and bespoke solutions, you’ll need a packaging partner who understands your brand’s specific requirements and delivers solutions rather than just items. Exactly, where Moglix Business comes in.

Moglix Business, India’s largest packaging solution provider provides comprehensive services to assist brands enhance their identity through smart and sustainable packaging.

Whether you want to lower your carbon footprint or make unwrapping more entertaining, Moglix Business has the experience to help you attain those goals

Packaging as a Brand Identity Tool

You know it and we know it – your role in shaping brand identity has never been more critical.

Packaging is no longer just about protecting the product; it’s about creating experiences, building trust, and reinforcing the values your brand stands for.

By choosing sustainable, innovative, and personalized packaging, you can strengthen your brand’s identity and foster long-lasting connections with your customers. And if you’re ready to take the next step, partnering with experts like Moglix Business can help you craft a packaging strategy that sets your brand apart. Know More

How Can Procurement Managers Use Sustainable Packaging to Reduce Carbon Emissions by 2030?

How Can Procurement Managers Use Sustainable Packaging to Reduce Carbon Emissions by 2030?

As a procurement manager, you have a crucial role in your company’s sustainability efforts. With India aiming to cut emissions by 45% by 2030, your choices of sustainable packaging can make a real difference.

Sustainable packaging isn’t just a trend—it’s becoming essential for meeting climate goals. By opting for eco-friendly packaging materials and smarter designs, you can help lower your company’s CO2 footprint and reduce waste.

This blog will show you how Moglix Business can help you to adopt sustainable packaging practices that not only cut emissions but also prepare your business for a greener future.

Focus Areas for Packaging Procurement Managers

Principle of sustainable packaging stands on 3 major pillars, which are preventing environmental pollution, enhancing recycled packaging and use of recycled materials, and lowering the CO2 footprint.

As a procurement manager, these are key considerations when making decisions. While many focus on recyclability and using recycled materials, there’s also a growing need to reduce CO2 emissions and prevent waste.

For example, some recyclable materials still have a significant CO2 footprint due to how they’re produced and transported.

It’s important to remember that these goals—reducing waste, improving recyclability, and cutting CO2 emissions—are interconnected.

Interconnected means you can’t have sole focus on one goal without understanding its impact on others can lead to less-than-ideal approach to sustainability goals.

For example, lighter materials may reduce emissions but make recycling more difficult.

Your role is to find the right balance, like how Moglix Business helped a leading e-commerce grocery brand achieve the right balance while transitioning to 100% sustainable packaging.

Procurement Managers Should Lead the Way Towards the Sustainable Packaging

As a procurement manager, you are uniquely positioned in the business value chain to create immediate as well lasting impact on a business or a brand’s effort of shifting towards sustainable packaging.

Here’s how you can lead the shift:

- Look and relook at your Current Packaging: Assess your packaging footprint, including materials, environmental impact, and costs.

Consolidate this data to identify optimization opportunities.

A cross-disciplinary team should manage sustainable packaging efforts, ensuring transparency and guiding eco-friendly packaging solutions.

- Begin with Design: Integrate sustainability into your packaging design by reducing unsustainable materials, selecting eco-friendly solutions, and improving user experience.

Reduce unnecessary packaging, use biodegradable products, and explore innovative sourcing approaches.

- Supplier Strength – Strengthen your supply chain by forming collaborations with packaging suppliers, waste managers, and recyclers to promote sustainability.

Collaborate with end-to-end packaging procurement partners like Moglix Business to get recycled materials, promote closed-loop solutions, and improve recycling operations

- Develop Internal Capabilities: Invest in training and technology to support sustainable packaging. Improve store infrastructure, reverse logistics, and stay updated on regulatory changes.

Cost Myth Associated with Sustainable Packaging

The typical barrier to adopting sustainable packaging, which always costs more.

In reality, investing in capabilities and engaging upstream in the value chain can mitigate these costs.

As per a Mckinsey report optimizing packaging processes and sourcing strategies can cut plastic packaging costs by up to 40%.

Although demand for recycled plastics may exceed supply by 2030, proactive measures can balance the initial premium with long-term savings and efficiency.

Looking Ahead to 2030; The Road to Net Zero Carbon Emission

Sustainable packaging is reshaping the industry. As consumers seek clarity and effective practices, businesses must stay proactive.

Moglix Business has been a key partner in this journey for many procurement managers across industries, offering end-to-end solutions from eco-friendly material sourcing to process optimization.

We help businesses turn sustainability challenges into growth opportunities. Know More about how we can support your sustainable packaging goals.

F&B Brands Shouldn’t Miss These 5 Hacks for Assembling Corrugated Boxes

F&B Brands Shouldn’t Miss These 5 Hacks for Assembling Corrugated Boxes

As someone who has seen India’s food and beverage (F&B) industry grow and expand, you know calling this industry competitive would be an understatement.

By now you also know, a food is a food, until your packaging drapes it with information and identity, and hence, packaging is more than just a protective measure—it’s a vital component of brand identity and customer satisfaction.

For F&B businesses, especially those addressing the needs of quick service restaurants and large-scale operations, the choice of packaging materials is crucial because you need to take care of the perishability aspect of the goods that are packed in it.

Corrugated boxes over the years have become the choice of brands because of their strength, durability, and circularity aspects. These boxes are shipped flat to save space and reduce transportation costs, but this means they need to be properly assembled on-site.

Assembly of these rigid packaging solutions seems easy but one error and the whole lot would have to be discarded. Here are five indispensable tips for pan-India F&B brands to excel in assembling corrugated boxes:

Choose the Right Corrugated Box Size

Selecting the appropriate box size is paramount to ensure products fit snugly and are without excessive space that may lead to shifting during transit.

According to a study by Smithers, right-sizing packaging can lead to significant reduction in damage, material usage and transportation costs.

Thumb rule – Accurately measure your products + select corrugated boxes that provide adequate protection + minimize empty space.

Master Folding and Taping Techniques

Efficient assembly begins with mastering folding techniques. Ensure all flaps are neatly folded and securely sealed using high-quality packing tape.

Unintended handling and shipping damages can be avoided, if the packaging team ensures proper sealing.

Thumb rule – Fold all flaps + fold on the pre-scored lines + quality packing tape + seal seams properly

Ensure Structural Integrity

Corrugated boxes are sturdy, but that doesn’t mean you don’t pay attention to the structural integrity of the corrugated boxes during assembly.

Depending on the items packed and mode of transportation, reinforce corners and edges to withstand stacking and transportation damages. Double taping and extra cardboard reinforcements could also enhance the strength of corrugated boxes.

Thumb rule – Use double taping + reinforcements

Labelling and Identification

Labelling provides a unique identity to the packed boxes and labelling practice during box assembly facilitates efficient inventory management and shipping process.

It’s imperative that you have a standardized labelling system that includes product information, barcodes, and handling instructions, which could potentially minimize errors, streamline warehousing and logistics.

Thumb rule – Labelling helps in streamlining processes

Quality Control Checks

After assembly quality control checks should be rigorously followed to identify and rectify any issues that may sacrifice product integrity.

Inspect folding, sealing, and structural soundness before packing products.

Thumb rule – Post assembly checks is as important as before and during checks

Takeaway

Understanding corrugated box assembly is essential for pan-India F&B brands seeking to enhance customer experience, operational efficiency and optimize cost.

At Moglix, we help both big companies and startups rethink their packaging needs. We offer solutions that cover everything from individual products to the entire process of getting them. To know more about our packaging supply chain solutions for corrugated boxes, click here.

How Procurement Managers Can Transform Experiences with Cutting-Edge Ecommerce Packaging?

How Procurement Managers Can Transform Experiences with Cutting-Edge Ecommerce Packaging?

According to Statista, by 2027, over 23% of consumer purchases would be made online and as an e-commerce CPO, you must have realized that the market is competitive.

This growth has made improving packing and shipping processes essential to recreate the personal touch of in-store shopping.

With hundreds of businesses selling similar products, standing out is challenging and hence you have seen a shift from the sell and forget model to relationship-based selling which focuses on creating customer loyalty and long-term relationships.

Over the years, the main job of packaging has been to protect products, so customers receive them in perfect condition, just like in a brick-and-mortar store. Packaging teams have often overlooked customer experience and satisfaction, in want protection.

But times are changing. One way to set your brand apart is through creative and thoughtful e-commerce packaging. So, what should you include in your packaging? Read on for six e-commerce packaging ideas that will truly delight your customers.

Keep Communicating

Speak Brand – Online shopping gives you a chance to keep talking to customers even after they’ve made a purchase.

Look at how brands like Zepto and Zomato who keep their fun vibe going through quirky messages on the brown paper bags, turning their boring paper bags used for e commerce into vibrant brand spokesperson.

It’s all about sharing your brand’s personality—even in your deliveries, think about adding a bit of your own style or a catchy phrase.

Answer Questions – Making sure customers get clear info about your product is another key area to keeping them happy and avoiding issues like complaints or returns.

Put product details and “how-to” right on your e-commerce packaging to guide them smoothly. For things needing assembly or specific instructions, include easy, clear steps on the package.

Easy to Reach – Returns are just a normal part of selling online, no matter how careful you are with quality. But they don’t have to be a headache for your customers or your business.

To make returns easy, include straightforward instructions right on your packaging.

Whether it’s a return label, a step-by-step guide, or even a simple QR code on the poly bags you use for ecommerce packaging, these make it simple for customers to manage returns smoothly.

This boosts their satisfaction and builds trust in your brand

Materials Matter

Sustainable Future – By now, we all get why sustainability matters. Consumers are willing to bet on, even with newer, lesser-known brands who focus on sustainability.

E-commerce brands in India should go for packaging made from recycled or recyclable materials. Packaging design that perfectly fits your product helps cut down waste by eliminating an additional packing layer.

Reuseable Packaging – Just picture getting your order in packaging your customers can use again and again. Reusable packaging not only cuts down on waste but also keeps customers coming back for more.

Globally brands are getting creative with ideas like collapsible boxes and packaging that doubles as storage solutions

Surpise to Delight

Little Extra – Surpise merchandise is a great way to grow your loyal community, enhance customer experience, and stand out from the competition.

Whether it’s gifts, coupons, stickers, magnets, free samples or references discounts, it puts a smile on your customers’ faces which helps build loyalty and drives repeat sales.

Make it a Memorabilia – Unboxing any Apple product is like a ritual. For a lot of customers, the excitement of carefully opening that perfectly snug box adds so much to the whole experience.

The box itself turns into a keepsake, reminding you of that special moment long after you’ve taken out the product.

Find a Right Partner

In a nutshell, e-commerce packaging could be a key to enhancing customer experience.

At Moglix, we assist companies of all sizes, big and small, in reimagining their packaging strategies. Whether it’s individual items or managing the entire shipping process, we’ve got you covered. Connect with our packaging expert to know more.

How CPOs Can use Ecommerce Packaging for Product Differentiation?

How CPOs Can use Ecommerce Packaging for Product Differentiation?

As a CPO, you know e-commerce is more than simply the product itself. It combines product, delivery and packaging together into a differentiated experience.

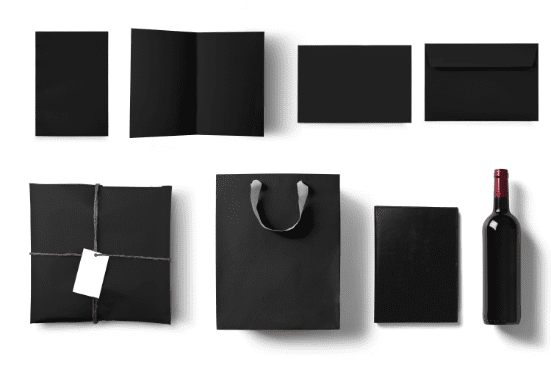

Unlike conventional storefronts, where customers can touch and check products, e-commerce is based on the visual and tactile experience of product delivery.

Focus on packaging, especially in e-commerce space can act as strategic for CPOs to reduce clutter and stand out, establish brand identity, and improve the entire customer experience.

Here’s how CPOs can use e-commerce packaging to effectively differentiate their products.

We will not delve into basics of packaging like “follow brand guidelines”, “speak the brand” or “be cost effective”. Those are bases that we are sure you have already covered. We will delve into areas that are inherent to e-commerce packaging.

Unboxing Experience is Inherent to E-commerce

The unboxing experience has become a crucial part of the customer journey. Thoughtfully designed e-commerce packaging can create a memorable unboxing experience, encouraging customers to share free, user-generated content that can significantly boost brand visibility and differentiation.

CPOs can work with designers to create packaging that surprises and delights customers. For example, unboxing any Apple product is more of a ritual.

For many customers, the theatrics of opening the perfectly snug fit box is an experience that adds value to their purchase, showcasing Apple’s meticulous design and attention to detail.

The box itself becomes a keepsake, symbolizing this memorable experience long after the product is removed.

Beyond the Apparent Use

Packaging needs to look good, be functional and especially in India, should have value beyond its apparent use.

CPOs should come up with designs that make things easier for customers, like for example, using resealable poly bags for e-commerce, which allow convenience, and sturdy boxes to keep items safe during shipping. In India households these bags and boxes are reusable.

Amazon did this with its frustration-free packaging, which is easy to open, recyclable, and makes shipping more efficient. This has made customers happier by cutting down on returns and has shown Amazon as a leader in packaging for online shopping.

Do more with Technology

Integrating technology into e-commerce packaging offers new ways to stand out. QR codes, for instance, can provide extra product details like sourcing and usage tips.

A brand that is consciously working to reduce its impact on the environment and uses tech to do so is Nike. It uses AR in its packaging, where scanning the QR code gives customers access to content such as sustainability initiatives, product info, styling tips, and promotions.

This technology focused strategy boosts engagement and creates a memorable brand experience.

Sustainability in Packaging Can’t be Compromised

Sustainability is a growing concern for organizations and consumers around the globe.

CPOs can differentiate their products by adopting sustainable e-commerce packaging practices by including recyclable, biodegradable, or reusable materials like paper bag packaging and poly bags for ecommerce in India. IKEA, a furniture company, has committed to eliminate plastic from its packaging by 2030.

They are also exploring innovative solutions like fully biodegradable packaging made from mushrooms, known as mycelium “fungi packaging.” This initiative is part of IKEA’s broader commitment to waste reduction and recycling.

Reimagining Product Differentiation with Moglix Solutions for E-Commerce Packaging

E-commerce packaging has come a long way from a mere protective layer to valuable, reusable commodity adding perceived value to the product itself.

For CPOs, focused on incorporating thoughtful design, brand alignment, technology, sustainability, and functionality into packaging can significantly enhance the customer experience and set their products apart in a crowded market.

However, as CPOs it’s essential to balance our admiration for design and branding with a commitment to sustainability and conscious consumption.

At Moglix, we help both big companies and startups rethink their packaging needs. We offer solutions that cover everything from individual products to the entire process of getting them. To know more, speak to our packaging expert.

CPG Procurement Heads Leaning towards Paper Packaging. Know Why

CPG Procurement Heads Leaning towards Paper Packaging. Know Why

As Procurement leader operating in the Consumer-Packaged Goods (CPG), you’re likely feeling the pressure to embrace more sustainable practices. Today’s consumers, especially after the pandemic, are looking for ways to reduce their carbon footprint. In India we have seen a trend emerging among top CPG brands – the switch to flexible packaging, specifically paper packaging.

Although the initial acceptance was sluggish, the rate of adoption has increased over the last couple of years. Industry giants like Walmart and PepsiCo have paved the way and are reaping real benefits by pioneering innovative practices that are driving this shift.

The story holds true not only for massive organizations with larger sustainability targets and budgets but also for various smaller hyperlocal startups. It’s time we understood the real reasons behind this growing wave and why now is the prime moment for your company to make the switch with the right partner like Moglix Packaging.

Paper Packaging is Versatile

Although the initial reason for accepting paper in packaging has been its green properties, the real reason why industries have persisted and embraced paper packaging is because of its versatility.

Advancements in manufacturing and design tech over the last decade have allowed for a wide range of paper packaging solutions, including rigid packaging for cereals and flexible packaging for snacks. Like plastic, Paper packaging is easily customizable, offering protection and a unique look that stands out on the shelves.

Curb Environmental Impact

Despite the popular belief, paper is not completely green, but the circularity it brings to the entire packaging ecosystem makes it a powerful raw material. Unlike poly bags, paper bags are biodegradable and far less complex to recycle.

The Central Pollution Control Board (CPCB) recently stated that India generates around 3.3MT of plastic waste annually. Shifting to paper packaging can significantly mitigate this environmental burden.

Government Regulations and Initiatives

Historically, the Government of India (GoI) has managed the plastic waste problem at State and Municipal levels, through education, bans and fines.

In 2022, India brought into effect the Plastic Waste Management Amendment Rules (2021) that banned 19 categories of single-use plastics.

Considering India is the 3rd largest producer of plastic in the world, these norms are going to push India up the global league when it comes to sustainable choices. By adopting paper packaging, you’re not just complying with these regulations—you’re staying ahead of the curve.

E-Commerce needs Paper Packaging

As per some estimates India’s e-commerce industry generated around 98000 tonnes of packaging plastic waste in 2021, that is equivalent to 98000 small cars. What is even more grave is the fact that this was a 73% increase compared to 2020.

E-commerce players with huge market penetration like Flipkart, Amazon India, as well as small e commerce Startups, are seeking ways to reduce their environmental impact. The Indian e-commerce market is expected to reach $200 billion (about $620 per person in the US) by 2026, and paper packaging will play a crucial role if this growth needs to be eco-friendly and sustainable.

Looking Forward

Paper is lighter than plastic, which reduces shipping costs, but there is no argument that transition to paper packaging is costly, but in the long run it will result in cost optimization, savings and positive brand image.

Additionally, it can streamline your supply chain by simplifying the recycling process and reducing waste management expenses.

Understanding these benefits will allow you to make a shift that will enhance the overall efficiency of your procurement process. Paper packaging can’t be seen as an alternative anymore; it is one of the preferred choices for leading CPG brands in India that aim to make a positive impact on the planet and their bottom line.

Procurement Leaders, by embracing this change, are positioning their brand for a sustainable future.

Moglix Packaging Solutions offer a variety of custom packaging solutions, and our packaging experts can assist you in personalizing the packaging requirements for your enterprise needs. Know more on how to seamlessly transition to paper packaging here.

Packaging`s Essential Role in B2B Product Marketing

Packaging`s Essential Role in B2B Product Marketing

According to recent reports, the sustainable packaging market is expected to reach US$ 490.5 billion by 2034. This underscores the demand for sustainable packaging in the manufacturing industry. It holds equal importance even in B2B product marketing with 66% of companies with such commitment. Let’s explore its importance and other aspects.

What is Packaging for B2B Product marketing?

B2B packaging, though refers to packaging, differs from B2C packaging. Here, brands go for tailored packaging solutions designed specifically for B2B transactions. The packaging in B2B marketing primarily focuses on practicality and efficiency over flashy designs. Even the use of materials, packaging design elements, and functionality all aim to meet the needs of businesses rather than customer perception for scaling.

How Does B2B Packaging Stand Apart?

Packaging Design

The packaging in B2B marketing is more focused on functionality than aesthetics. The aim is not to dazzle with vibrant colours but to adopt a more straightforward functional packaging approach centred around goods safely and efficiently. For instance, consider IKEA that incorporates their signature blue and yellow into functional packaging elements like boxes and bags.

Functionality

B2B packaging involves sturdier materials that can assure protection against the rigours of industrial environments. For insrance, Caterpillar is known for using heavy-duty corrugated cardboard and metal banding for their construction equipment for safety against harsh environment. If the packaging can help ensure safe transport and handling, it will be best received by brands seeking to overcome supply chain challenges.

Target audience

B2B functional packaging appeals to businesses and professionals. This difference in target audience requires a unique approach to communicating a clear brand message while conveying reliability and trustworthiness. One of the best examples is Samsung that clearly details product information and diagrams directly on their packaging for users.

The rising importance of Sustainability in Packaging

With 75% of companies already being affiliated to explore sustainable packaging commitments, there has been a significant demand for the same in B2B product marketing. Eco-friendly packaging solutions are the new trend. In the rise of the circular economy, 30% of organisations have clear metrics surrounding recyclability content. This commitment is essential from the business’s point of view to enhance brand reputation and attract environmentally conscious clients.

Driving business success through Sustainable Packaging

Enhanced B2B Branding

Nearly 70% of B2B buyers think about sustainability as one of the top three priorities while partnering with suppliers. With sustainable packaging, businesses can easily improve their portfolio and build lasting relationships with B2B customers.

Improving Customer Satisfaction

Around 60% of customers from developing countries are looking for sustainability while making purchases. When you provide the same and ensure that products arrive intact and undamaged, it fosters reliability and counts for high customer satisfaction.

Driving sales and revenue

Eco-friendly packaging is no longer just a requirement but a competitive edge. Europe has experienced 36.7% revenue from companies with sustainable packaging. With increased B2B branding, well-competitive differentiation, improved customer perception, and reduced packaging waste, it is imperative for brands to experience high sales and revenue with sustainable packaging.

Conclusion

Sustainable packaging is not just a regulatory obligation. Now, you can also call it a strategic differentiator. That’s why brands are considering sustainability to packaging to gain a competitive edge and partner with environmentally conscious clients. Moreover, going for sustainable packaging initiatives can become a source of brand pride and a compelling selling point in the B2B marketplace.

Looking for the best sustainable packaging solutions? Partner with the right packaging solution provider. Moglix helps you with the right functional yet sustainable packaging innovations for long-term relevancy and impact. Visit our website to learn more.

Analyzing Consumer Perspectives on Food Packaging | the Positive, Negative, and Unappealing

Analyzing Consumer Perspectives on Food Packaging | the Positive, Negative, and Unappealing

The packaging industry is going through new trends every year as per consumer behavior. Nearly 60% to 80% of customers want a “wow” factor during unboxing. The same consumer perspectives apply to food packaging as well. In this regard, it’s important to understand what food packaging factors excite them and what drives them to switch brands with the first impression.

Different Food Packaging Factors Affecting Consumer Perspectives

Convenience

Would you not prefer a food package with resealable closures? Because they help keep foods fresh while you’re on the go. That’s one way of adding convenience to packaging. Weight is another factor. Lightweight packaging not only counts as one of the positive aspects but also saves companies a lot on shipping costs. Some other deciding factors could include the shape of the packaging, flexibility, ease of product dispensing, and serving portions.

Eco-friendliness

Nearly 69% of customers can g o for a premium price if the product is made up of sustainable material. This is a clear boost for brands to adopt eco-friendliness in packaging. The two biggest positive aspects of eco-friendly packages are they are non-toxic and allergy-free. That’s why customers with pets and toddlers feel safe with such packaging. Plus, eco-friendly materials are the biggest boost towards reducing the carbon footprint (greenhouse gases) in the atmosphere. Environment-conscious customers also know that this strategy can help them reduce toxic emissions by up to 45% by 2030 and reach net zero by 2030, as per the Paris Agreement.

Unclear labelling

If a product’s packaging is confusing, it can negatively influence the pacakging perceptions of customers. For instance, jumbled texts and tiny symbols drastically reduce customer engagement. It would be difficult to identify ingredients, understand nutritional information, and figure out portion size. That may also create a lack of trust and induce decision paralysis in customers. This is the reason brands highlight essential information in simple language designed with bold, readable font sizes. For instance, brands like Nature Valley, Honest Tea, and Ben & Jerry simplify their packaging language with icons, bold fonts, and relatable potion size indicators.

Overuse of plastic

Despite so many environmental concerns, nearly 141 million tonnes of plastic packaging are generated every year. Surprisingly, 50% of those plastics are used only once. As a result, such packagings contribute to 1.8 billion tonnes of carbon emissions per annum. In this regard, customers are getting quite serious about reducing plastic usage to save the planet. As per a survey, around 87% of consumers expressed they would like online retailers to minimize the quantity of plastic in the packaging they use.

Looking for sustainability in your packaging solutions that positively influence consumer behavior and packaging perceptions of your brand?

Let Moglix help you with trending packaging innovations that score high on consumer perspectives. Visit our website to learn more.

Decoding Consumer Perspectives: The Impact of Food Packaging Trends

Contract Manufacturing Advantages: A Comprehensive Guide

Contract Manufacturing Advantages: A Comprehensive Guide

Contract manufacturing is growing a lot, especially in the Asia-Pacific area. Industries like electronics and pharmaceuticals are driving this growth. The global market is expected to grow by 5.3% each year from 2021 to 2030.

Along with the rising demand for custom goods and services, this trend shows how contract manufacturing can help save money and spark new ideas.

Companies can reach their goals, meet their needs, and keep the high standards they want when they work with makers to outsource production. The contract manufacturer produces the goods, tests them, and sends them to the purchasers.

Contract manufacturing vs. Traditional manufacturing (OEM)

Businesses often contemplate between contract manufacturing and OEM. They look at cost, control, and speed. A survey asked this to 163 industry professionals, and 85% chose contract manufacturing. Businesses aim to use resources better and want to focus on core tasks.

Contract manufacturing improves quality and brings new ideas. OEM offers more control and protects intellectual property. However, OEMs cost more and need to be more flexible. This shows contract manufacturing meets market needs and supports industry growth.

Outsourcing Manufacturing: Benefits

Last year, Apple started to make 12 billion iPhones in India. They focused on buying parts locally and making assembly better. Outsourcing manufacturing is getting more common. This way, they save money and get other big benefits, too.

- Proximity to End Customers: McKinsey has found less international shipping of products now. More goods are being made and sold locally, especially in growing markets. A good example is how semiconductor chips are made in Asia for local customers. This helps cut down on shipping costs and makes delivery faster.

- Operational Savings: By outsourcing, firms can close or make their local plants smaller. This lets them focus more on research and development and helping customers. It also cuts operation and ownership costs.

- Access to Raw Materials: Costs can go down for local manufacturers close to the source of raw materials. This is helpful for fields that need a lot of different materials, like the semiconductor industry.

- Specialized Suppliers: Dedicated suppliers are available in manufacturing hubs such as Asia. Local manufacturing makes precision equipment and technology more affordable.

- Product Development Expertise: Some countries are popular for contract manufacturing. For instance, Malaysia is an expert in electronics. It helps big companies like GE and Siemens produce faster and cheaper goods.

- Specialized Personnel and Equipment: Outsourcing allows access to special machines. It helps hire skilled people for short jobs. This means we don’t need temporary workers. We also don’t need to buy expensive equipment.

- Ease of Product Movement: Contract Manufacturers who know trade laws can move products easily between countries. This lowers the risk of legal problems.

Advantages of partnering with a contract manufacturer

In 2023, Intel partnered with eight companies in India to make laptops locally. They did this for a few smart reasons:

- Saving Money: Making things in India costs less because the workers and materials are cheaper. Intel doesn’t have to spend much money setting up its factories.

- Making Better Laptops: By working with these Indian companies, which are good at what they do, Intel can ensure their laptops are of high quality and get to customers without delay.

- Reaching More People: Intel is also changing some of their laptops so they can sell them in India and other new places where people are looking for good, affordable technology.

- Making things this way helps Intel save money, make better products, and sell to more people worldwide. It’s a clever plan to grow their business and develop new ideas.

Best practices for risks and compliance management

Your Request for Proposal (RFP) is very important when choosing a contract manufacturer. It helps you pick the best one by looking at their services, financial health, tech skills, and legal compliance. Make sure they have a strong history of success, know what they are best at, and can handle your project’s tech needs. Be careful about risks, like protecting your ideas and checking all legal details.

Final words

Companies can now choose where to make their products worldwide. This use of special skills and cost cuts has made manufacturing global. China is a big player in electronics and consumer goods. Southeast Asia, Eastern Europe, and Latin America are also important. The choice depends on labour costs, infrastructure, and how stable a place is.

To navigate the global manufacturing shift, learn more about partnering with contract manufacturers through insights from Moglix.

Navigating Seasonal Packaging Trends for 2024

Navigating Seasonal Packaging Trends for 2024

52% of consumers make repeat purchases from brands with unique packaging. Brands are finding new ways to make their product packaging match what customers want. They use cool designs made of recycled materials that match the seasons, like Christmas or summer. Let’s understand what new seasonal packaging trends you might see in stores this year.

Understanding what consumers like in Packaging

Did you know that 72% of people are more likely to buy items in a cool package? There are many things to consider to make a package look great. For instance, lots of folks love packages with bright colors and fun pictures, which makes them want to choose that item more than others. Besides making it look fun, companies also consider who will buy their stuff, like how old they are or if they live in the city or the countryside, and consumer behavior to make their packages look super appealing.

Top 2024 Packaging Innovations and Seasonal Market Trends

Sustainable Packaging

Nearly 69% of consumers are ready to bear extra costs for sustainable products. That is why sustainable packaging is the trend. In this regard, brands use eco-friendly materials to align with customer values. This also helps companies meet sustainability demands while maintaining packaging quality per consumer preferences.

Minimalism in Design

The demand for minimalist package design is also accelerating. As per the latest survey, around 76% of consumers like product packages with clean lines, simple color palettes, and uncluttered designs. All it takes is to bring sophistication and authenticity to stand out on those crowded shelves in that minimalist packaging aesthetics.

Interactive packaging

Big e-commerce platforms like Flipkart, Myntra, and Amazon also use interactive technologies (e.g., QR codes) in the packaging to increase consumer engagement. For instance, the QR code allows access to additional product information through the mobile device that brands find hard to fit into the package design.

Custom packaging

Big brands like Birchbox, L’Oreal Color & Co hair dye, Concrete Jungle, and Le Petit Trou have nailed custom packaging. Custom packaging means making packages that match special times of the year or big events. When companies put pictures or words that customers choose on the package, the product feels special and exciting. This also helps people recognize and love the brand more while meeting consumer preferences.

Limited edition (seasonal) product packaging

Limited edition packaging is when companies make special packages for certain times of the year, like Christmas or Halloween. They use colors, symbols, and pictures that remind people of that holiday or season. This makes customers feel happy and remember good times, which makes them more interested in buying the product and helps the company sell more.

End Thoughts

The packaging industry is seeing new packaging market trends based on consumer behavior. Brands are now paying more attention to personalized packaging to increase customer satisfaction. Focusing on completely sustainable packaging solutions is the best approach to staying ahead in the market.

Looking for ideal future-proof packaging solutions? Partner with the right packaging solution provider.

Choose Moglix to leverage the latest packaging innovations for long-term relevancy and impact. Visit our website to learn more.