Key Supplier Selection in B2B Procurement’s Packaging Revolution

Key Supplier Selection in B2B Procurement’s Packaging Revolution

Packaging serves as a powerhouse, influencing product quality, customer satisfaction, and operational efficiency. Well-crafted packaging serves as a visible commitment to a supplier’s competitiveness and sustainability goals, leading to reduced costs and waste. The integration of technology, such as IoT and data analytics, amplifies operational efficiency. Future trends center around sustainability, customization, and digital integration. Be proactive in anticipating regulatory changes and staying informed. In the dynamic B2B landscape, strategic procurement, particularly in selecting suppliers with packaging expertise, is essential for gaining a competitive advantage.

Packaging for the Future: Sustainable Solutions in E-commerce

Packaging for the Future: Sustainable Solutions in E-commerce

In 2022, global e-commerce sales stood at $5.63 trillion which represents nearly 19 percent of retail sales worldwide. Forecasts indicate that over the next five years, the online segment will make up close to a quarter of total global retail sales. This provides a fillip to the e-commerce packaging market which has enjoyed a CAGR of 20% since 2017 and expects to grow further.

The growth will be led by packaging manufacturers who continue to innovate as per the needs of the market.

Reducing Carbon Footprints: The Cement Industry’s Path to Sustainability

Reducing Carbon Footprints: The Cement Industry’s Path to Sustainability

The global cement industry produces an estimated 4 billion tons of material yearly fueling infrastructure that shape our daily lives, while contributing whopping 7% of global emissions. With this, the industry stands at a critical juncture. The good news is that the cement industry is waking up to its responsibility and is taking bold steps towards a greener future, innovating eco-friendly cement and sustainable packaging solutions.

In the wake of this, the World Cement Association has announced its goal to reduce CO2 emissions by the cement industry by at least 25% by 2030.

Circularity at Scale: Transforming the Packaging Industry

Circularity at Scale: Transforming the Packaging Industry

In its 2022 report, Circularity Gap Initiative revealed that only 8.6% of all material used by humankind is recycled, with the rest contributing to the rising waste levels. A circular economy prioritizing recycling and reuse is the need of the hour that entails keeping raw materials, goods, and services in circulation for the longest time possible, limiting the level of waste that gets generated on a global scale.

Most of the per capita waste generated globally comes from primary, secondary, and tertiary packaging; hence, the packaging is one of the focus industries that should adopt circularity. Circularity in packaging necessitates achieving sustainability along with good business sense for better adoption and longer haul.

Engineering a circular future with sustainable packaging

Engineering a circular future with sustainable packaging

India generates 3.5 million tonnes of plastic waste each year, as per data available from the Ministry of Environment, Forest, and Climate Change1. Moreover, India’s per capita generation of plastic waste has nearly doubled in the last five years. Besides adversely affecting the ecosystems, plastic pollution is linked to air pollution.

Against this backdrop, sustainable packaging could play a major role in curbing India’s carbon footprint as plastics comprise one-third of the carbon emissions in core manufacturing segments such as mining, metals and construction materials. The next highest contributors in this regard are energy, agriculture and related activities, logistics and HVAC, followed by other verticals.

Issues and Implications of Sustainable Practices

To mitigate the ravages of global warming, corporates across countries and continents are shifting to sustainable business practices that support a circular economy and advance efforts to curb climate change.

Moglix helping companies solve their enterprise packaging challenges

Moglix helping companies solve their enterprise packaging challenges

The packaging vertical of Moglix claims to meet the needs of around 70 percent of e-commerce orders in the country. Shobhit Goel in discussion with Paper Mart shares insights on how Moglix is helping companies gain visibility with aesthetically crafted packaging Solutions

PM: Please shed some light on Moglix and the key accomplishments of the company so far?

SG: The digital supply chain ecosystem of Moglix brings together 7 lakh+ SKUs of indirect procurement, packaging, infrastructure construction materials, made-to-order manufacturing, and supply chain cloud SaaS products to create the largest catalog for B2B commerce in India.

“Moglix Solutions has been able to transform MRO procurement and packaging for global enterprises using a state-of-the-art unified procurement platform. At present, we are working with over 600 large-scale enterprises.”

PM: Please tell us about the product range on the platform.

SG: As I mentioned earlier, we have several verticals, such as MRO, infra solutions, manufacturing as a service, fashion and packaging. With respect to Packaging solutions, we at Moglix, collaborate with businesses to map their packaging challenges and deliver relevant solutions in the primary, secondary and tertiary packaging. We currently serve all three types of packaging.

PM: What are the future plans of the company?

SG: This is just the beginning! We believe that paper is a strong segment and will continue to focus on that aspect.

“There is a scope for improvement in R&D, and assessing the ways to make paper packaging even more sustainable and reduce the carbon footprint of the paper mills.”

The Future of Sustainable Packaging for Manufacturing in India

The Future of Sustainable Packaging for Manufacturing in India

Sustainable Packaging is the need of the hour – with just under a decade left to achieve the sustainability goals.

The Plastic Waste Management Amendment Rules, 2021, announced in August by the Union Ministry of Environment, Forest, and Climate Change (MoEFCC), identified that 20 Single-Use Plastic Products (SUPs) will be phased out by next year. In India, 18 states have already implemented a complete SUP ban, but the upcoming July milestone will extend the legislation across the country. The shift to more sustainable packaging material will need to be swift, and manufacturers will need to display vision and plan not to be impacted by supply chain disruptions in the transition process.

The Search for Alternatives Begins:

Paper is a more sustainable option than plastic. Industry figures indicate that packaging consumes more than 49% of all paper produced in India.

Eco-friendly Innovations that will dominate 2022

Repeat-use packaging

Bio-based Plastics

Paper-based packaging

Edible packaging

How can brands play a more prominent role?

Product packaging plays a prominent role in the purchase decision of the consumer. Primary packaging makes a difference to the customer’s first impression and the brand recall later.

Brands need to put technology at the center of their transformation, create robust governance models to govern operations and collaborate with a broader ecosystem to make a significant impact footprint.

What will drive sustainability in packaging?

By placing digital technology solutions, material innovation and process optimization at the core for a better tomorrow, the government, businesses, and the supplier ecosystem can usher in a new age of conscious commerce.

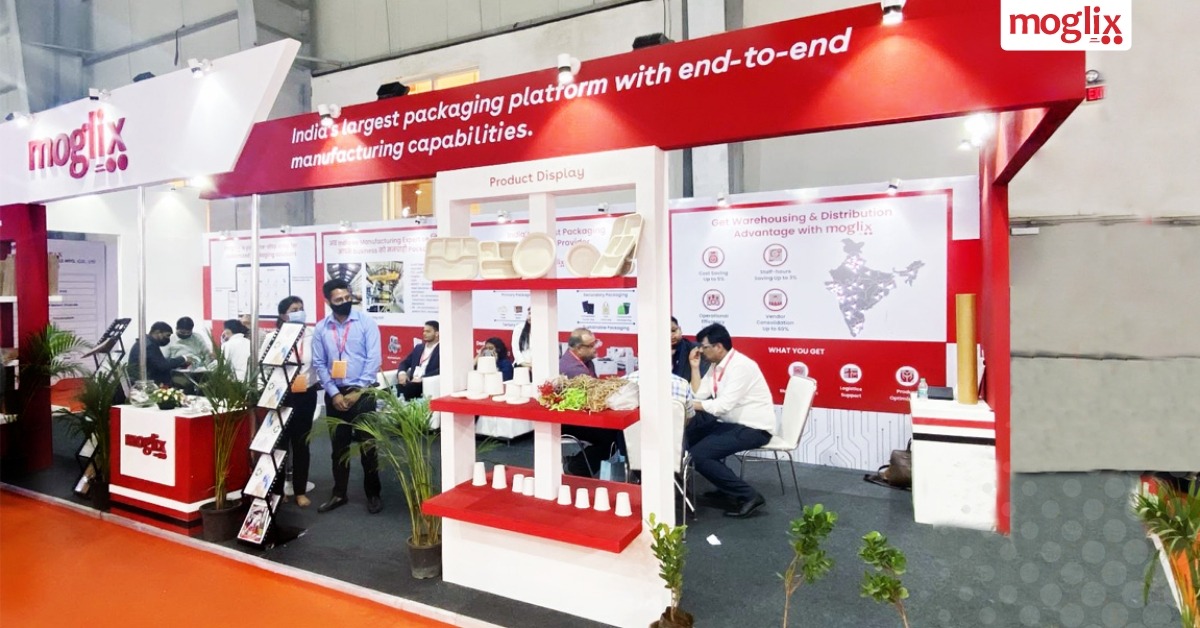

Moglix Packaging Solutions Exhibited at Paperex 2022

Moglix Packaging Solutions Exhibited at Paperex 2022

At Paperex 2022, Moglix reinforced its vision and mission as the country’s largest integrated packaging solutions provider. Moglix Packaging was showcased with various products, such as paper bags, paper tubs, bagasse trays, corrugated boxes, compostable bags, paper tapes POSS, shredded papers, paper cups, along with raw materials demonstrating a range of specialty papers for converters.

Moglix is also a manufacturer of packaging products and raw materials (Paper, Poly and Aluminum roll), exhibiting full-stack paper-based offerings from raw materials to finished goods.

Moglix fulfills more than 70% of the e-commerce industry’s packaging demands, including inventory management that stretches across 35 warehouses in pan India. It provides an end-to-end supply chain of paper products through strategic tie-ups with different mills, converters and JIT fulfilment by leveraging its pan-India distribution network.

Paperex 2022 is one of the largest Paper exhibitions in the country. The event was accompanied by research and development professionals from academic institutions, product users, customers from the printing and publishing industry, decision-makers from well-known industries, sourcing personnel, paper technologists, promoters, and many more. The exhibition showcased Moglix capabilities on a national and global scale.

Through this platform, we established long term relationships with various stakeholders in the paper industry, and contributed towards creating a sustainable and stronger supply chain across the manufacturing value chain.

The company brings complete packaging supply chain solutions all in one place

The company brings complete packaging supply chain solutions all in one place

Rahul Garg founded Moglix in 2015 to bring the ease, speed and convenience of E-commerce to the B2B world. This manufacturing sector company is a B2B E-Commerce startup providing services for procurement of industrial products such as MRO items and Packaging.

As a contract aggregator and supplier of packaging materials since 2019, the company has worked for brands such as Zomato, Swiggy, Lenskart.com, IRCTC, Comesum, Rebel Foods, and several others. In packaging supply chain procurement, its efficiency comes from its expertise in leveraging volume purchasing with the use of digitalization, vendor consolidation, product and pricing uniformity, benchmarking, and new product development.

The company offers primary, secondary and tertiary packaging made of all materials – paper, plastics and films, metal or glass. Packaging types and formats include food trays, pet bottles and jars, laminates, sachets, pouches, kraft sealable bags, lamitubes and many more.

Moglix’s onsite delivery of sustainable SKUs such as paper bags, compostable bags, molded trays, bagasse trays, cotton carry bags, and bespoke biodegradable packaging are provided to more than 25,000 pin codes. The company inventory management stretches across its 35 warehouses across the country. Food and beverages, E-commerce, ePharma, and logistics are the company’s main customers and its packaging materials fulfill more than 70% of the E-commerce industry’s packaging demands.

The company’s USP is in its ability to provide complete packaging and supply chain solutions in one place. The customer does not need to go to another platform to find the component. Customers are provided with access to a buyer’s portal where they can track their current order along with re-ordering.

The company’s business is scalable as Shobhit Goel, Senior vice-president of Packaging and CapEx at Moglix adds, “We operate as an entire ecosystem of packaging supplies right from raw material to the finished product. We have recently kicked off operations in the UAE and are planning to tap the global market.”

The Current Packaging Industry Scenario

The Current Packaging Industry Scenario

Given the global macroeconomic outlook, the packaging industry can be cautiously optimistic about a rebound. We see 8 to 10% growth in India in the intermediate term. India’s growth rebound will follow global trajectories. However, local factors like the offline to online shift will have a profound impact on the economic rebound and thus on the growth in the packaging industry. E-commerce enablement in India is now higher than ever before. It will have a spillover effect on growth in the packaging industry.

There are several constraints on the global packaging supply chain. One of the major factors is the evolving role of China as a net importer of kraft paper due to a surge in demand for both its domestic and global trade requirements. Polymer pricing has been volatile both globally and domestically. With greater adoption of sustainable packaging, paper prices have inflated over the last two years. This has also been the case in the Indian packaging industry. Furthermore, polymer manufacturing in India has a highly imperfectly competitive market morphology. Market share and production capacities are dominated by a quantity leader. It has repercussions on the pricing of packaging material procurement. Government intervention in the form of price ceiling can enable the pass-through of cost cushion from MSME suppliers to enterprise buyers and end customers.

There are two significant avenues for the Indian packaging industry to adopt technology. First is the manufacturing of packaging materials. Second is the digital transformation of the packaging supply chain. Technology adoption in the manufacturing of packaging materials can facilitate capacity expansion, bring economies of scale, and reduce unit costs. On the other hand, collaborative data sharing among the stakeholders in the supply chain can get greater visibility into demand and supply mapping across locations in India, pricing, and agile distribution. Stakeholders in the packaging industry can benefit by moving away from a siloed approach towards a digitally connected supply chain ecosystem. It will make the packaging supply chain more demand-driven and efficient.